Data-Driven Stock Alerts

Satisfaction Assurance

500+ International Contributors

Global Reach

SODALITY ANALYTICS

BROKER RECOMMENDATIONS

SODALITY ANALYTICS

BROKER RECOMMENDATIONS

How-To Invest in TSX and TSXV Markets: An Overview and Our Top 3 Recommended Brokers

Investing in the Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) markets is an appealing option for U.S. investors looking to diversify their portfolios with Canadian securities, including stocks, mutual funds, and exchange-traded funds. TSX and TSXV stocks provide a wide range of opportunities beyond what is typically available on U.S. exchanges, including companies positioned for high growth. Below, we recommend three U.S. brokers that offer seamless access to these Canadian markets.

Charles Schwab

Charles Schwab supports trading of TSX and TSXV stocks via OTC tickers. All trades are executed in U.S. dollars, making it easy for U.S. investors to navigate these Canadian markets.

Fidelity (International Platform)

Fidelity’s International Platform provides U.S. investors access to TSX and TSXV securities. It allows full quotes for Canadian-listed stocks and supports trading in multiple currencies.

Interactive Brokers

Interactive Brokers offers a seamless trading platform for U.S. investors to access a broad range of Canadian stocks listed on the TSX and TSXV. Their platform supports trades in Canadian dollars for full access to TSX-listed stocks.

Can U.S. citizens buy stocks listed on the Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV)?

Yes, U.S. citizens can buy stocks listed on TSX and TSXV. Many U.S. online brokerages, such as Interactive Brokers, Fidelity, and Charles Schwab, offer access to Canadian-listed stocks. You can trade these stocks directly through their platforms using either Canadian dollars or U.S. OTC tickers.

How do I trade TSX and TSXV stocks as a U.S. investor?

There are two main ways to trade TSX and TSXV stocks:

Through U.S. Online Brokers: Platforms like Interactive Brokers and Fidelity’s International Platform allow full access to TSX and TSXV listings in Canadian dollars. Charles Schwab provides access via OTC tickers in U.S. dollars.

Through a U.S. broker: If your broker doesn't offer access to TSX and TSXV stocks, you can contact them to inquire about trading options. If they don't support Canadian securities, consider switching to one of the brokers that does.

What is the difference between TSX and TSXV?

The TSX (Toronto Stock Exchange) is Canada's primary stock exchange, listing larger companies with higher market capitalization.

The TSXV (TSX Venture Exchange) focuses on smaller, high-growth companies. It’s ideal for investors looking for early-stage opportunities with higher risk but potential for significant returns.

I don’t see a specific TSX or TSXV stock on my online trading platform. How can I trade it?

If a particular stock isn't available on your platform, contact your broker to find out if they support trading it. For direct access to TSX/TSXV listings in Canadian dollars, we recommend using platforms like Interactive Brokers or Fidelity. If trading through Charles Schwab, you'll need to use the stock's OTC ticker symbol, traded in U.S. dollars.

Can I trade TSX and TSXV stocks in U.S. dollars?

Yes. Through Charles Schwab, you can trade TSX and TSXV-listed stocks via their OTC tickers in U.S. dollars. However, using platforms like Interactive Brokers and Fidelity allows you to trade directly in Canadian dollars, which may offer more flexibility and better access to Canadian markets.

I purchased shares in a TSX or TSXV company through a private placement. How do I get these shares deposited into my U.S. brokerage account?

If your U.S. broker is unable to deposit shares bought via a private placement, you can reach out to firms specializing in trading TSX/TSXV securities, such as Haywood Securities or Canaccord Genuity. These firms can assist in making the shares tradable in your U.S. brokerage account.

What are the benefits of trading on TSX and TSXV as a U.S. investor?

Trading on TSX and TSXV gives U.S. investors exposure to sectors that are highly active in Canada, such as natural resources, mining, and technology. Canadian markets also offer opportunities in small-cap stocks, often with high growth potential, especially through TSXV listings.

How do currency exchange rates affect my investments in TSX and TSXV stocks?

If you trade TSX and TSXV stocks using Canadian dollars, fluctuations in the exchange rate between U.S. and Canadian dollars may impact your returns. Platforms like Interactive Brokers and Fidelity support trading in Canadian dollars, giving you access to real-time exchange rates. If you trade using OTC tickers through brokers like Charles Schwab, your trades are executed in U.S. dollars, which eliminates the need to deal with currency conversion directly.

What kind of stocks are listed on the TSX and TSXV?

The TSX and TSXV offer a wide variety of stocks, including large-cap companies, early-stage high-growth ventures, and businesses from industries such as mining, energy, biotechnology, and technology. The TSXV, in particular, is known for listing smaller companies that are in the early stages of development but have the potential for significant growth.

Each of these brokerages provides a secure platform to trade OTC securities, along with a range of tools and resources to support your investment journey. Remember to review the fee structures, available resources, and trading options to choose the brokerage that best suits your investment needs.

🚀 Need more assistance: Not sure how to begin? Let us help you open your OTC trading account with ease. Our step-by-step guidance ensures a smooth onboarding process with your chosen broker.

How-To Invest in the OTC Market: An Overview and Our Top 3 Recommended Brokers

Investing in Over-the-Counter (OTC) markets can be an appealing option for American investors looking to explore a broader range of securities, including small-cap stocks, foreign equities, and emerging companies. OTC markets offer a diverse portfolio beyond what is typically available on major exchanges like the NYSE or NASDAQ.

Over the years, Sodality Financial has developed deep expertise in identifying and evaluating the most effective trading platforms for OTC market transactions. Our thorough research and client-focused approach have allowed us to cultivate strong relationships with leading brokers, giving us unique insights into which platforms best serve different investor needs. Based on our extensive analysis and client feedback, we present our top three recommended brokers for OTC market transactions:

Charles Schwab

Charles Schwab provides a comprehensive trading platform ideal for accessing OTC markets. It offers advanced trading tools, research, and low fees. Schwab is known for its user-friendly interface and robust customer support, making it an excellent choice for both new and seasoned investors.

Fidelity

Fidelity is another popular brokerage that grants access to OTC securities. It boasts a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Fidelity’s platform is lauded for its research tools, educational resources, and customer service. Its transparent fee structure and investor-friendly policies make it a top pick for many.

Wells Fargo

Wells Fargo offers a reliable platform for OTC trading through its WellsTrade service. The brokerage provides a straightforward platform with competitive fees, making it accessible for investors of all levels. Wells Fargo’s comprehensive financial services, including banking and lending, can offer added convenience for investors looking to manage multiple financial needs under one roof.

Each of these brokerages provides a secure platform to trade OTC securities, along with a range of tools and resources to support your investment journey. Remember to review the fee structures, available resources, and trading options to choose the brokerage that best suits your investment needs.

🚀 Need more assistance: Not sure how to begin? Let us help you open your OTC trading account with ease. Our step-by-step guidance ensures a smooth onboarding process with your chosen broker.

No experience necessary

Some Of Our Winners From 2024

+105.42%

NASDAQ - NVDA

+75.00%

TSXV - AEMC

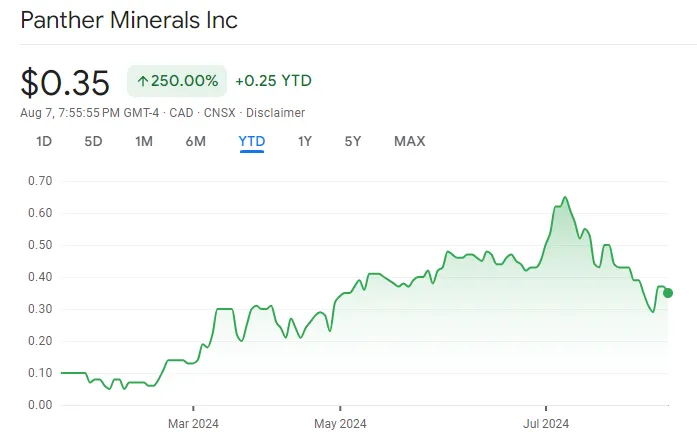

+250.00%

CSE - PURR

+55.17%

IQ.VN

+164.15%

OTC - DEFTF

+12.50%

CSE - WCU

+49.56%

LSE - KWS

STILL GOT QUESTIONS?

Frequently asked questions

When will I get my first stock analysis and alert?

As soon as you sign up you will receive a text alert with the stock pick of this month.

What stocks can I expect?

We don’t tie ourselves to any particular sector instead we utilize our AI and expert analyse to pick the stocks with the highest potential in different categories using globally pooled information to discover up and coming investment trends, basically put we give you the news before its on the front page.

What do I get with an Elite subscription?

We believe in going the extra mile for our Elite subscribers. That's why we offer a dedicated Market Professional exclusively for you. Get personalized insights, investment themes, news, alerts and analysis live as it happens, allowing our Elite member to be proactive rather than reactive.

Not sure which plan is right for you? Fill in the questionnaire and we'll do the rest!

Copyrights 2024 | Sodality Analytics™ | Terms & Conditions

Disclaimer: Any person accessing this website or page and considering potential investment opportunities featured here, should make their own commercial assessment of an investment opportunity after seeking the advice of an appropriately authorized or regulated financial advisor.

This website or page should not be construed as advice or a personal recommendation to any prospective investor. Investments of this nature carry risks to your capital and can go up or down. Past performance is not indicative of future results. Suitable appropriately qualified investors, sophisticated and high net worth investors only. - FULL DISCLAItMER HERE